Mergers and acquisitions (M&A) are a main driver of growth for many organizations, with the main objective of cybersecurity M&A due diligence being to identify and eliminate any risks for all sides involved in the transaction. This is why it’s important to conduct this process in a safe cloud environment such as a dedicated due diligence data room where you can handle all sensitive data and transactions.

The steps involved in the M&A process often look as follows:

Image from Corporate Finance Institute

The M&A process isn’t completed overnight, there is a lot of information to be gathered, reviewed, and merged as separate entities combine into a joint venture. With that in mind, conducting penetration testing for cybersecurity resilience can play a crucial role in mitigating risks throughout this process.

What is Pentesting?

Pentesting or penetration testing involves cybersecurity professionals attempting to breach specific computer systems, networks, or applications to identify areas of weakness. Pentesters are equipped to gather all of the necessary background information on a company and current ownership through M&A.

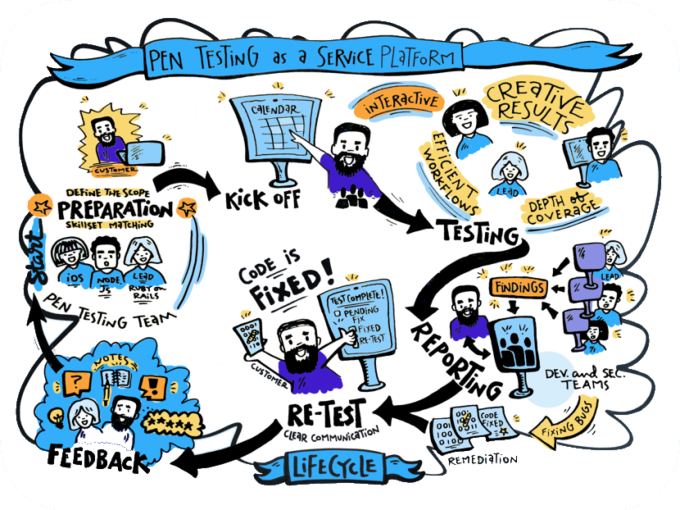

When considering implementing penetration testing engagements for M&A, first consider the value of protecting major business assets and how those play a role in driving the merger or acquisition. Utilizing pentesting with a Pentest as a Service (PtaaS) platform, companies planning to merge or acquire can think ahead by identifying and fixing infrastructure vulnerabilities. Furthermore, a PtaaS platform enables companies to test more assets, faster. This can be critical for M&A testing since companies in the due diligence phase will often face external factors that rush the process — external factors such as competing buyers, LOI deadlines, or other time-sensitive norms within the M&A sector.

Image from What Is Vulnerability Management? Get the Answers You Need

It’s recommended for companies to undergo security testing to prevent data breaches, especially prior to significant changes such as product launches associated with mergers and acquisitions.

Explaining the importance of M&A for cybersecurity leaders, “How to navigate events that can either make or a break a CISO's career: mergers and acquisitions and audits and penetration testing” states: “To use a merger or acquisition as an opportunity to help them professionally, security leaders need to consider security risks that could impact the merger and communicate their plans to address those issues to the board of directors and executives at the companies that are joining.”

The Return of M&A

With mergers and acquisitions expected to rise in the coming year, the process remains a powerful tool used by executive teams to grow and scale their business. However, opportunities for business growth also come with potential security threats when data is involved.

“In the post-COVID-19 economy, cyber risk and cybersecurity will play a central role in unlocking mergers and acquisitions (M&A) deal valuations. While economic uncertainty has contributed to a decline in M&A activity in the first half of 2020, many analysts expect an increase in deals during 2020-21.”

Along with this, more than one in three executives say they have experienced data breaches due to M&A activity during integration, according to Reducing the Risk of Mergers and Acquisitions.

Cybersecurity M&A Due Diligence

“Well-executed cyber due diligence is a key factor in the successful closing of a merger or acquisition deal. With cyber threats growing in complexity, performing your cyber due diligence is essential as it protects you from a variety of financial and reputational risks. With a detailed account of a prospect’s cybersecurity and data privacy practices, organizations are better able to evaluate any risk they may incur once a deal has been finalized.” - Why Cybersecurity Due Diligence is Essential in M&A.

Cybersecurity due diligence in M&A transactions highlights these three areas to consider in cybersecurity M&A due diligence:

- Review of the target company’s current cybersecurity policies

- Review of the target company’s network security conducted by an outside firm

- Deal terms in the acquisition document

Part of successful cybersecurity M&A due diligence is assessing and evaluating current organizational security posture and taking the next steps to ensure security longevity. Security planning and cyber due diligence lead to strong IT infrastructure, so your organization can see the impact on your business acquisition strategy.

Protecting your organization throughout the M&A process

Many organizations fall short of pinpointing vulnerabilities and mitigating risks, especially when it’s overlooked in the M&A process. Considerations such as implementing penetration testing early on in the M&A deal lifecycle can make a difference before any long-term security loss or damage.

Businesses of all sizes and across all industries are subjected to cyberattacks — an internal vulnerability assessment ensures potential threats and areas of weakness are identified and prioritized to prepare for the next steps. Poor M&A cybersecurity comes at a cost: when merging with or acquiring another organization, total visibility of the companies merging is a challenge and the door can be left open for potential threats, associated fiscal repercussions, and more.

Benefits of PtaaS to M&A

The Pentest as a Service model combines data, technology, and talent to resolve security challenges for modern web applications, mobile applications, and APIs.

Pentesting gives quick access to security details and insights that are crucial for security teams and long-term business plans. It lets organizations know if and how hackers are able to breach systems and compromise sensitive information. The additional level of protection pentesting provides helps teams get in front of security gaps, along with other key benefits including:

- Efficiency at speed, aligning with M&A objectives

- Finding weaknesses in security posture

- Monitoring security performance through built-in analytics

- Ensuring long-term business continuity

- Avoiding costly data breaches

Whether your security team is looking to prepare for cybersecurity M&A due diligence or is interested in learning more about pentesting, read more about how pentesting can become a more effective layer of defense for your business and discover pentesting made easy.